A look at what I've been seeing in crypto lately

Exploring the state of RaaS (and L2s and L3s and L4) + explaining some of my issues with restaking

Sunday, June 2nd // 6:16 pm EST

I figured the best way to get back into writing is through treating it like note taking - I’ve been in the habit of daily, handwritten notes for a few months now but never thought to put it into a blog format. Today I’ll be looking at a few of the leading RaaS (Rollups-as-a-Service) providers and sharing my opinions on restaking. The goal isn’t to be as concise or as analytical as possible, it’s to get some writing down and formalize my thoughts.

I hope you enjoy.

RaaS is a bit of a contentious topic given the sentiment around rollups (L2s and L3s). You’re either supportive of platforms like Caldera and Conduit that make spinning up a rollup incredibly easy or you’re someone that thinks we already have too much blockspace and these tools are pointless. My beliefs fall somewhere in the middle but both sides make strong arguments. I think rollup infrastructure is a net-positive for the space (no matter how small it might be) but I also see why people don’t view this technology as capable of moving the needle on crypto adoption.

L2Beat shows a list of about 55 live rollups - the top five of these (Arbitrum, Optimism, Base, Blast, and Mantle) hold a market share of 82.74% as I’m writing this. I’m not sure if we should interpret this as us being early to crypto, a symptom of undifferentiated rollup designs or just a general lack of interest in the vast majority of rollups - maybe it’s just a combination of all three.

Arbitrum and Optimism are easily the most established rollups and feel more like “genuine” chains at this point (as opposed to Ethereum sidecars). Base has a very active community and is probably the most well positioned rollup currently, despite its smaller TVL - something similar can be said for Blast, though I’m not confident their higher TVL is a better selling point than the community Base has built without the help of a gamified points program. Base has even explicitly stated there won’t be a token but nobody cares because this is the first rollup to ever see organic activity - even Arbitrum and Optimism were heavily farmed prior to airdrop announcements.

Mantle is the one rollup I’m very unfamiliar with but I’ve looked around the ecosystem briefly and think they’re positioned better than someone like Mode, Manta or even Scroll. How it plays out for them is entirely dictated by TVL inflows and new app deployments, both of which are TBD until further notice.

Even worse than the 55 live rollups is L2Beat’s list of 44 upcoming rollups. There are a variety of different designs used across these 44 (like Optimiums and Validiums) but at the end of the day these are all competing for the same market. Very few live rollups have made that previously mentioned leap from “modular execution layer / ethereum sidecar” to “dominant chain that just happens to be an L2.”

L1s become successful when years of developer talent accrues into a fundamentally sound base layer, giving the opportunity for a community to form around this and create ecosystems (think Solana’s memecoin casino arc, Ethereum’s DeFi summer frenzy or even ordinals on Bitcoin). The utility of a rollup comes from its shared security with the base layer - in 99% of cases this is Ethereum, unless you’re discussing a Solana L2 - and from its relatively lower transaction costs.

I don’t think technicals on their own are enough to give a rollup significant mind or market share, evident by some of the “strongest” tech like Scroll, Taiko and Polygon zkEVM not even cracking a dent in the TVL game. Maybe these teams do see an increase in TVL over the long run, but I see no indication of this happening based on current sentiment and lack of pursuing it thus far. No, your eight users don’t want to do another Galxe campaign and they definitely don’t want points that can be exchanged for non-transferable tokens.

If you were to put yourselves in the shoes of a brand new, fresh-faced crypto investor who was blissfully unaware of what a smol ting was, how would rollups make you feel? I’m not certain you’d be jumping for joy seeing the 15th zero-knowledge rollup with an EVM-equivalent zkEVM or something, unless it had a few memecoins you could make money on, of course.

Most of this brief analysis (a simple glance through L2Beat) presents itself as pretty bearish, but as long as I’m not the one yeeting LP money into L2s or L3s I’m content with it. I don’t think an ever-increasing number of rollups is necessarily a bad thing for the space either, but we should be more upfront about the utility this brings. Many apps have become application-specific chains over the past few months (Lyra, Aevo, ApeX, Zora, Redstone) and I suspect the trend continues until everyone from Uniswap to Eigenlayer become L2s.

So while we can’t prevent the number of new rollups deploying, we can at least try to be honest about the effect it has on crypto. We have too much blockspace and Ethereum mainnet isn’t even in need of any extra blockspace - it costs maybe $10 maximum to make a transaction right now and it’s been that way for weeks.

RaaS providers like Conduit and Caldera are fairly undifferentiated (don’t shoot me) and I’m only saying this as confidently as I am so someone out there can hopefully correct me on how I’m wrong. Here’s a brief rundown of both of their respective rollup deployment processes:

- Conduit offers OP Stack and Arbitrum Orbit; Caldera offers Arbitrum Nitro, ZK Stack and OP Stack

- Conduit offers Ethereum, Arbitrum One and Base as settlement layers; Caldera doesn’t list off settlement layers though I imagine it’s pretty similar

- Conduit’s DA offerings include Ethereum, Celestia, EigenDA and Arbitrum’s AnyTrust DA; Caldera offers Celestia and Ethereum though plans to integrate Near and EigenDA soon

- Conduit lets you use any ERC-20 as a native gas token; Caldera lets you use DAI, USDC, ETH, WBTC and SHIB (???)

Overall these two platforms are quite similar. I imagine the only differences come from the actual consultation experience you’d receive from the team. I haven’t spoken with either of the teams yet so I apologize if any of this comes off as hasty or uninformed, but I’d like to think they’ll appreciate an honest look at RaaS and where the space is currently at. We’ll find out soon enough.

I’ve thought about making my own rollup for fun but I can’t really justify spending $3,000 a month on a fake chain (unless any VCs want to slide in my DMs, then we can talk).

Wrapping things up, I like RaaS and hope that everyone working on it continues to do so. I really don’t see a problem with it and think shouting to the void about “too many rollups” is a stupid hill to die on considering the state of our industry.

On the topic of the state of our industry, it’s time to briefly discuss some of my gripes with restaking, LRTs, AVSs and Eigenlayer. I still want to write a larger report on this so I’ll keep it shorter than I’d like to.

Eigenlayer has a massive amount of ETH deposited in it, roughly 5.14 million as of today. For a while I thought most of that would evaporate after the points program ended, but the world’s most disappointing airdrop announcement didn’t result in TVL fleeing to greener pastures, it actually went up. I think that anyone who expected Eigenlayer’s airdrop to be an easy 20-25x on deposited capital was probably fooling themselves, but I didn’t expect them to geoblock basically every major country after the fact. There are enough tweets that express discontent over Eigenlayer’s double standards here (including one from me) but I really don’t think it’s worth discussing this anymore.

The team also released a massive white paper to explain what EIGEN does and introduced a new concept called intersubjective utility. No one really knows what it means and no one is writing threads on it because EIGEN will initially be non-transferable, a massive no-no for anyone looking to build a community around their protocol. If you can’t make people rich with a token or the ecosystem that revolves around a token, people will simply migrate their attention towards an avenue with money making possibilities (like memecoins).

I don’t have an issue with Eigenlayer or the team. I’d like to get that out of the way.

It’s unfortunate to say, but I have an issue with restaking as it is and the basket of AVSs currently whitelisted on Eigenlayer. With over five million staked ETH deposited into Eigenlayer you’d think people are earning good yield on this, right? I’m here to tell you that assumption is wrong. I’m going to be referencing one specific dashboard quite a bit so here’s a link to it.

If you think about the utility of restaking you default to bootstrapping economic security from the world’s most economically secure blockchain’s validator set. You take stETH of all varieties and throw it into a restaking platform like Eigenlayer (or Karak and eventually Symbiotic) in return for a greater yield on the already attractive stETH yield. My issue with this is that there’s no inherent yield generation that comes from restaking - the yields must flow from the AVSs presented within Eigenlayer. If you’re a restaker and have 10 stETH deposited in Eigenlayer and delegate this restaked ETH to an operator like ether.fi, you’re trusting them to then select the correct basket of AVSs to produce yield for you.

But where does this yield even come from?

It’s not like Ethereum has a new clause written into the protocol layer that promises more rewards for ETH stakers if they go and risk it in a restaking protocol. The yield can only come from one place: AVSs themselves launching tokens.

I’m not an expert and I know most of us don’t claim to be, but I struggle to see how no one else has brought this up on Twitter. Sure, bigger issues like a pretty awful airdrop and existential risk to Ethereum’s security take priority, but how has no one asked the simple question of what might happen once Eigenlayer launches and slashing is eventually enabled?

Where’s the incentive to keep my assets deposited when a) the team hasn’t discussed any real numbers on potential yield generation and b) AVSs that have no business holding over $10 million are sitting on $500 million or more of restaked ETH?

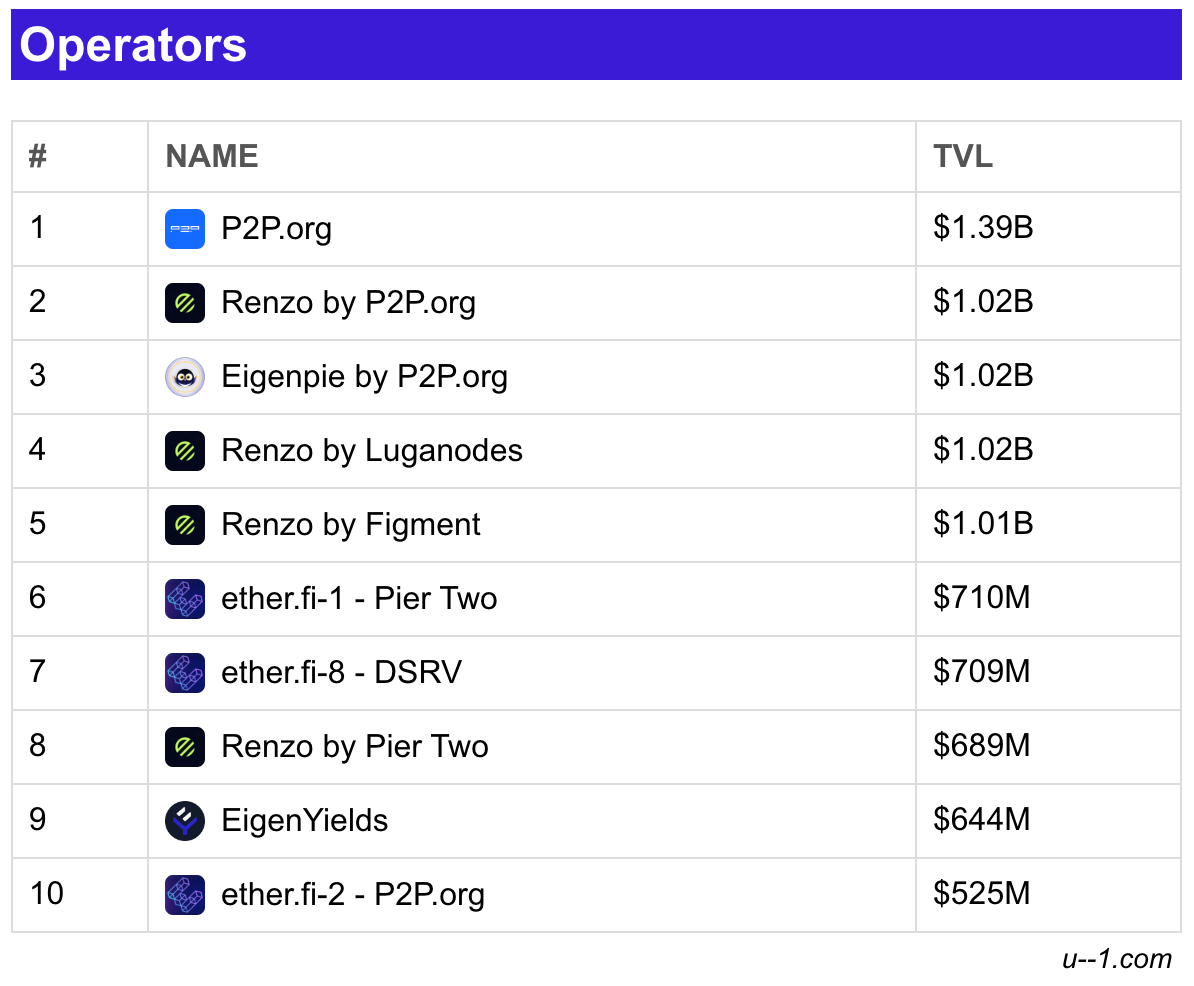

This leaves us in a scenario (let’s just call it reality) where the top ten operators on Eigenlayer have an average number of 5 AVS registrations each, with significant overlap between each other. Eigenlayer was smart enough to announce slashing isn’t live for a year or so while everyone gets acclimated to the new restaking reality. Smart move considering no one has discussed restaking risk outside of Gauntlet and Mike Neuder. As quality as both of these write-ups are, there really aren’t any concrete examples to offer because AVSs are doing almost nothing as it stands.

As I previously stated, the benefits of Eigenlayer are very cool - there’s no denying that. But is it really necessary to offer every nascent protocol close to a billion dollars of your users’ restaked ETH and subject them to that future risk? Slashing isn’t enabled but in less than a year it will be - are operators fully aware of their restaking risk and how this risk is compounded with each subsequent AVS registration?

I’m not sure.

Maybe we see a few other restaking platforms slowly churn away at Eigenlayer’s market share, ideally with smaller amounts of restaked ETH awarded to AVSs while they gradually find product market fit, not the other way around. I’m interested to learn more about Symbiotic, so if anyone on the team or close to the team is open to chatting with me in a confidential setting, please send me a message and I’d be happy to talk.

I’ll avoid rambling on about this for too long because I’ve realized how much I want to write a report on it, so I think that’s all for now. Expect maybe 1-2 of these a week as it’s been a pretty effective exercise for coming to conclusions on my many jumbled notes. Talk to you all later.

what happen the next ?

continue airdrop to do it ?

At the first time, i spend monkey to get airdrop, waht we do next ?

Very insightful and first-principle driven.

You're not even mentioning that half of the yield AVS pay will go to $EIGEN stakers.

One question for you:

Rationally speaking, should ETH FDV > LST (gov tokens) FDV > LRT (gov tokens) FDV?

The market is currently valuing $LDO at 2.3B FDV and $EIGEN between 20 and 30B FDV. Something feels wrong here (okay, Eigen also offers DA but still)