Introduction

I own positions in some of these tokens but legally cannot trade them in a way that benefits me. None of this is financial advice and I’m sure many of these tokens won’t perform in the way we hope they do. Ape as you see fit.

It’s been a few hours since I last posted, but it appears that my writer’s block is through. I discussed the crypto markets in a very brief post, and it’s time I write something more substantial with a little more data to back up my claims. As this article is being written, DeFi TVL sits at around $106 billion, down from its peak of nearly $250 billion. The top five protocols are Maker, Curve, Aave, Lido and Uniswap - all five currently referred to as “blue chips” amongst crypto natives. What would it take to dethrone the top five and send Maker dominance to ATLs? The goal of this article will be to explore DeFi as it stands today in order to determine where it might be in the future. Strap in.

Oh, and to avoid any confusion, I’ll refer to some categories in this write-up that might not fit the DeFi bill entirely, but that I chose to include because I believe will eventually be synonymous with what the masses refer to as DeFi. And I don’t plan to mention all of the protocols inserted into the article graphic, that’s on you, dear reader, to explore - let’s just call it bear market homework.

Many losers and some winners

As DeFi has aged, we’ve seen ponzi games mature and become more complex / veiled, masking the multiple layers of economic alchemy designed to strip traders of their precious dollars. Whether it be the food farms of DeFi’s distant past, OHM forks of DeFi’s relatively recent past, or the long sustained ponzis of the present which are very hard to unwind, DeFi has been built on the back of casino-like tendencies mixed with economic structures that would make Bernie Madoff jump from his grave.

After the collapse of UST and Anchor Protocol, TVL vanished from Terra, giving Ethereum roughly 65% dominance over DeFi, with Binance Smart Chain and Tron not so close behind. How has this occurred, and why do funds keep flowing back to Ethereum despite its nasty gas fees and stacked competition from alternative L1s like Solana, Avalanche and Polygon? The answer is not so simple, and the truth is I don’t have much of an answer. My best guess involves the idea that DeFi was created on Ethereum and is more or less destined to live out its life cycle on the chain to beat all other chains. Ethereum has seen its L2s like Arbitrum, Optimism, zkSync and Starknet grow in popularity and usage, partially playing into the almost inevitable possibility that DeFi TVL eventually remains 100% concentrated in the casino of the internet.

DeFi TVL is currently represented by some pretty reputable protocols (see: top five mentioned) and looks responsible if you only stick around the top 25 or so. Past that, we begin to see the real ponzis pop up. If you’ve scoured defillama any over the past few weeks, you would have noticed that many protocols are experiencing extreme TVL volatility. 25% inflows one day, -40% outflows the next, -65% outflows over the last 7 days - you name it, DeFi has done it. While there are is shortage of opportunities for those looking to earn yield over the long-term (potentially), the situation looks pretty bleak currently. Stable yields across many protocols are sitting in the 3-6% range if you’re lucky, after regularly operating over double digits for many months. If we can’t provide liquidity on our precious backed stablecoins, what else do we have to offer?

I believe that DeFi will lean into the following categories over the next year:

Lending and borrowing

Structured products

Derivatives

Cross-chain smorgasboard

“But Knower, you can borrow from protocols like Aave or Compound and-”

Nah, this is different. If we want to attract institutional capital from the big boys, we gotta market ourselves to the big boys.

Lending and Borrowing

I think we’ll see protocols like Maple, Goldfinch and Clearpool grow their TVLs considerably as trust amongst more crypto-native protocols wanes after the unfortunate Terra event. Yes, I’m saying DeFi is going to become less decentralized. This is bad, but it can be kind of good if you have a “glass half full” perspective. Maple has already outperformed many of its peers in terms of TVL strength, token price and relative attention-grabbing (metric I’ve made up) while tons of protocols have been scrambling to claw back their precious TVL. The same can be said for Goldfinch and Clearpool, although Maple has done it better, simple as that. You can still earn double digit stable yields on Maple, by the way.

Lending and borrowing is huge, as many people have lots of money but can’t always make use of it - borrowing against your collateral is a way to do this. Aave and Compound grew because of the inherent need for crypto whales to gain more money, with deposit incentives which procured these magical funds in the first place. This model has largely contributed to DeFi’s current state, as 99.9% of protocols must launch with LP incentives to muster up any traction / attention / deposits in the first place. This isn’t always a bad thing, but it does prevent a lot of the trash in crypto from getting taken out simply because of farm & dump plays which can be done fairly often. DeFi doesn’t really have a major use case right now aside from making some people money, some people a lot of money, and many people no money at all. This can be from impermanent loss, shitty tokenomics, lack of PMF or some combination of the three, among other more qualitative factors. Oh, and TradFi has trillions of dollars, and with just 1% of these following into DeFi, we’d all be rich. Moving on.

Structured Products

Structured products are an interesting story, mainly because of how they’ve been marketed in DeFi up until now. DeFi’s whole thing is yields, and structured products are fundamentally designed to offer high yields, it’s just tougher to make them stick. Sure, you could hop onto one of the protocols and see a theoretical yield of 42% on an ETH cc or csp - but why do this in such a volatile market where you leave yourself with an obligation to buy if it goes down or cap your upside on a major move up? Yes, I get that these products are primarily for hedging, but crypto is still very early in its life cycle and these will become more important as time goes on. Regardless of their utility, it can be seen that they do have a place in the current market. If you can’t get desired yields from anywhere else, structured products could become your friend.

Maybe we won’t see a ton of overly degenerate strategies with structured products, but there’s a high chance we will. If crypto enters its next cycle with structured products still in-place (getting tired of typing out structured products every ten seconds) there are so many opportunities to combine ponzinomics and theta into packaged weapons of destruction for millions of retail investors. Imagine the possibilities of selling a covered call on the probability of a DeFi founder rugging his project for > $20m && < $25m in the next month while simultaneously selling CSPs on the project’s token in hopes a major fund bails out user funds within the same day.

This is the casino GCR constantly references - embrace it.

Some of the protocols that have been working hard in this space are Ribbon, Friktion and Timeless; among many others, of course. I think that if these protocols can survive and maintain quality product offerings + consistent TVL inflows, they will become very big one day. Do with this info what you will. Structured products are also very big on Solana, partly why I’m so bullish on the L1 as a consensus #2 pick behind Ethereum. The only issues I see with Solana are its network outages, current shitty tokenomics for many of its older alts, steep hardware requirements to validate the chain and with this relative centralization. Derivatives are also very big on Solana right now, leading me into the next section.

Derivatives

Crypto has struggled to see many of its on-chain options protocols take off in terms of usage and TVL, leading to a renaissance for protocols like GMX, dYdX and Drift. Despite market downturns and general lack of liquidity, GMX saw new users flock in like crazy. Just look at this chart, it’s literally up-only:

GMX isn’t alone in this, as volumes for perp trading have been doing very well, I just don’t care to pull up all the data on this lovely Saturday night.

Source? Just trust me.

On-chain business has not been going as usual, but these perp platforms’ respective tokens have been holding up quite well despite all the chaos surrounding most other alts. Projects like dYdX have really bad tokenomics and good usage, meaning that there could become a point where it’s just stupid to not buy the token as it’ll more than likely get scooped up by larger players as a “value” play. We have DeFi blue chips, why not perpetual blue chips? Protocols like Drift, Perpetual Protocol (it’s in the name) and 01 Exchange are all very interesting and have seen a great deal of interest, it’s on them to maintain their volumes, keep users happy and ensure they don’t go bust.

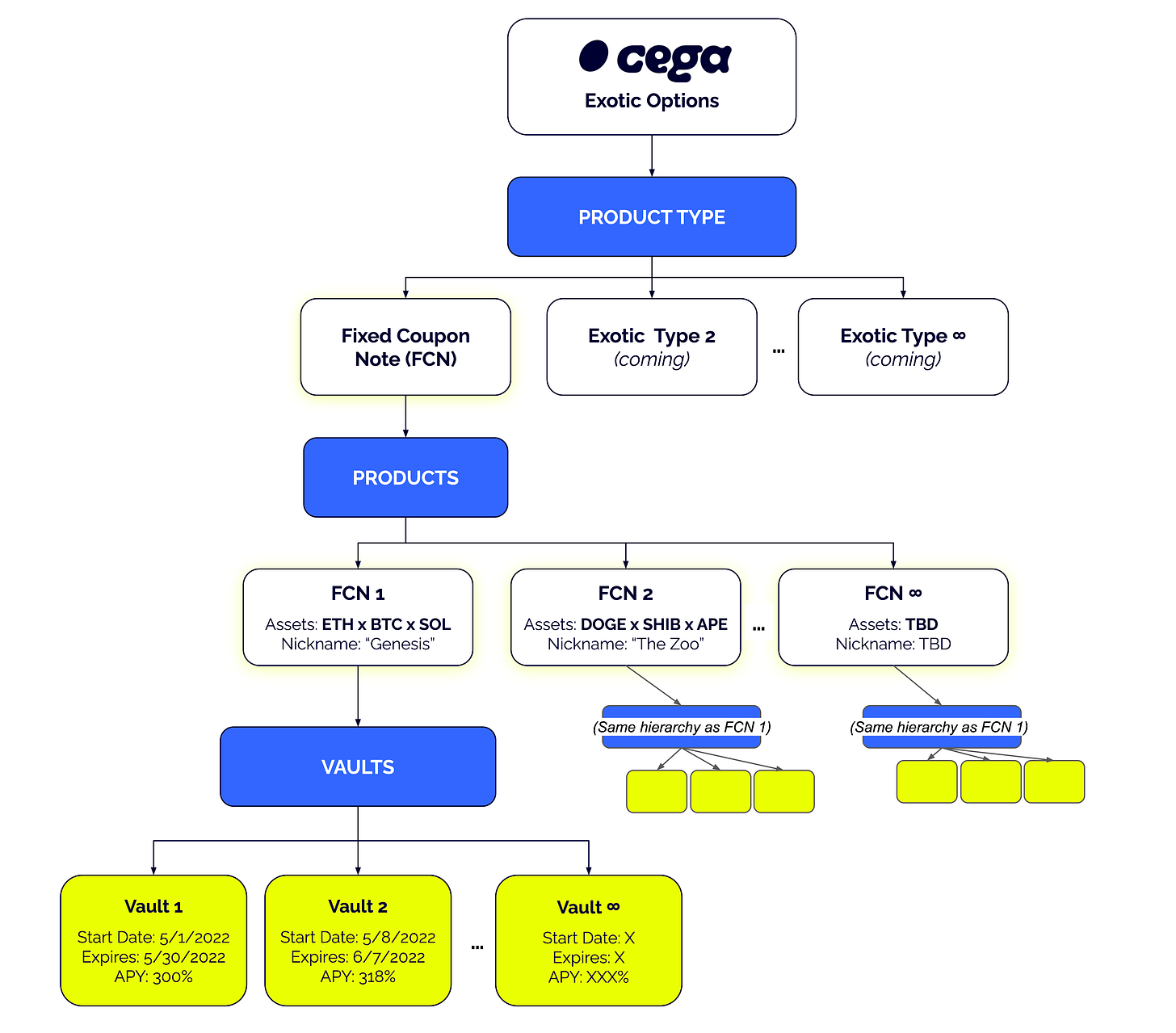

Looking at other derivatives protocols, there are a few that fly below many of our radars, like Cega, Vega and Zeta (silly little names, I know). Usage across many relatively new on-chain derivative platforms aren’t up to par with some of the bigger names I’ve mentioned, but they are offering some very cool, valuable and unique products to users willing to take a stab into the unknown. To give an example, check out this image from Cega Finance’s docs:

Referencing the above, I think it’s fair to assume we’ll see a lot more of these types of products across crypto. This lies more in the vein of structured products, but it is a derivatives platform and derivatives tie into structured products - blah blah blah, not going to change the structure of the article this far through - I hope you get the gist of it. Going back to my point on options, there just isn’t enough money in DeFi to pull this off at a satisfying scale. There aren’t an extreme number of reasons for market makers to take the other side of the trade, as there’s often far more monetarily attractive ways to make a buck in the market that don’t involve decentralized options protocols. Does this mean we’ll never see options for our precious on-chain gems? No, it just won’t happen as soon as we want it to.

Perps appear to be king, from both a qualitative and quantitative perspective. They’re fairly easy to understand and leverage is something everyone enjoys, even if they lose money with it 9.9 times out of 10. Expect perp volumes to continue their march up and to the right.

Cross-chain

I’ve decided to include a section on everything related to cross-chain (very brief, saving the majority of it for a future article) because it directly coincides with the growth of DeFi. Over the course of 2021, we saw an “alt L1 szn” play out again and again and again. Seriously, the same playbook was run like 10 times and it worked almost without fail (until it didn’t). Ethereum dominance in DeFi TVL got chopped down further and further as the combinations of up-only L1 tokens, ecosystem funds and bullish VCs led to meteoric rises in TVL in everything from Avalanche to Fantom.

While many of these chains have now fallen far off the face of the Earth (see: Fantom) there are still an extremely larger number of reasons to be bullish on a multi-chain future enabled by protocols like Synapse, LayerZero, Wormhole, Axelar, Celer and a ton of others that I don’t want to list off. Many of these make tons of money in swap fees, hold huge TVLs and offer services that are essential to crypto in its current state - there isn’t much not to love about bridges and functionality that enable dApps to build natively on bridges. Not to mention the fact that many of these cross-chain solutions have plans to transition into their own chains at some point in the near future, leading to a potential “alt bridge / cross-chain as undervalued L1s szn” (yes, of course I made this up) that could send some of these tokens and these protocols’ future tokens up in a way similar to that of the alt L1s. But this is a major pipe dream of mine, hopefully we all share it.

When you think about the future of DeFi and where it could end up in regards to mass adoption, a future of chain agnosticism makes a lot of sense. When we interact with payments in the meat world, we don’t know what underlying services are powering and processing our transactions - we just do as we do. This could become the case with DeFi, far after the period where all 7 billion of the world’s population are gambling UBI on DeFi ponzi games with a DeFi TVL dwarfing that of TradFi as it stands today. But I digress.

Looking ahead

Hopefully this article provided you with some much needed hopium. Goblintown isn’t all it was hyped up to be, as unfortunate as this is. I think we should all try and stay positive no matter how much money we’re losing, as the future is very bright. If you ever feel disenfranchised with crypto or DeFi in particular, I recommend you read some sci-fi to help you dream up all of the crazy ways we might end up spending money on ponzis in the future.

As always, follow me on Twitter @knowerofmarkets if you want to follow my journey through the Wild West / Ghost Town that we call crypto. Peace out.

Knower is really the best writer on CT w/out a doubt

This is an awesome piece! how did you go about finding protocols to research?