Dani's vision

The mad hatter of decentralized finance is at it again - with some help from a friend

* Before I start, huge shoutout to @GrayVMatter on Twitter for the cover photo. Go check them out for more beautiful art. *

A little story about human behavior

Let’s hop back in time.

In the 20th century, families used to gather around the radio or television at night to watch the news. This was before the CNN versus FOX News wars, a battle even more nonsensical than the Curve Wars if you can believe it. Before 24/7 news, there was only the nightly news. You and your family would gather around your household’s newfangled machine that could project sound out of it, and you would listen to the latest stories and happenings. Times were simpler.

On June 1st of 1980, everything changed.

I introduce to you the day the first 24/7 live news broadcast aired, a day that will forever live in infamy. Let’s travel back to before the days of Crypto Twitter, before the days of stalking your ex on Facebook, before even the internet had been thought up. Let’s go back to before the media became oversaturated and overfixated on bullshit stories meant to rob you of your time and attention. Going forward, this will probably be a pretty American perspective, so I do apologize for my international readers. Bear with me.

Prior to the creation of the 24/7 broadcast, the news was actually - for lack of a better word - newsworthy. A single half hour timeslot proved to be a near perfect amount of time to distill the world’s most recent events into an informative experience for viewers. Unfortunately, this has ended.

24 hours in a day often feels like not enough time for most of us. We have social lives to live, shitcoins to ape into and Twitter threads to read. There isn’t nearly enough time to do all of this. While it might be true in 99% of cases that a day is too short, 24 hours for a news broadcast is actually way too much time. There simply isn’t enough going on in the world to justify 24 hours of interesting and valuable content.

When the media attempts to replicate this formula 365 days a year, sensationalism comes with it. How do news stations and media outlets keep their viewers’ attention in a world filled with a population who are slowly losing their ability to maintain focus? It’s simple - twist stories and stir up emotions. Create something out of nothing, and never stop doing it.

We’ve seen this phenomenon exasperate itself in recent years, partially thanks to the 2016 election cycle which saw a record amount of disinformation and media warfare over the controversial election of Donald Trump. But we won’t go into that, because most of us are too lazy or distracted to pay any attention to politics.

Regardless, the media managed to perfect its method of drawing in viewers and capturing their attention. By totally leaning into the concept of tribalism - in this case left versus right politics - media giants like CNN and FOX have been able to gain huge and emotional audiences, ones that will defend their interests with every ounce of their being.

If you spend your days waking up, going to work, coming home to eat and then settling in to watch some of the news, you will quickly fall into a routine. If you’re one of the many Americans who absorb all of their information from one media source, you quickly develop a bias. It doesn’t matter what side you’re on, you will end up in an echo chamber. More on this later.

The year is now 2022, and we’re beginning to see a country that is fatigued. The COVID-19 pandemic has been raging on for almost two years now, and people are tired and upset. The media doesn’t provide the truth, and any answers they give us often don’t hold up by the end of the week. People want to return to normalcy, but it feels like a fading hope with each passing day.

Let’s observe this fatigue through a more familar lens, the murky and cracked lens of CT.

If it wasn’t already clear enough, all of us who participate and engage in discourse on CT are stuck in a huge echo chamber. Not only do we spend our days trading shitcoins and conversing with anonymous accounts with nothing but an anime PFP to go off of, but most of CT seems to be unemployed with a net worth in the 7-8 figure range. Or at least, this is what I’ve been told.

If you inhabit CT and are one of the few still working, you’re more than likely working in crypto in some way or another. Maybe you’re building the decentralized Opensea of feet pics or the metaverse for Papua New Guinea. Either way, you’re in the trenches and getting paid in stables. It’s entirely possible none of your co-workers have seen what you actually look like. The entire situation is odd.

However, Twitter isn’t just for us. There are actually a ton of other people who use Twitter, and we probably make up less than 1% (if that) of Twitter’s active userbase. In case you want a comparison, some of the more popular CT accounts like Cobie and Loomdart don’t even have a million followers. Do me a favor and go see how many followers Steve Harvey has.

I’ve set the stage for a description of a unique echo chamber, one that compares to the echo chambers of media and politics but ultimately differs in a lot of ways. Either way, we are in an echo chamber whether you want to admit it or not. The truth is, a lot of us have not made it. Most accounts on CT only lurk and don’t post anything of value, or even worse try and flip NFTs with their paycheck and seethe in replies when you don’t buy their ElonMarsRocketCoin bags. For more examples of this, just go through @TheMoonCarl’s replies.

In fact, CT as we know it is only a smaller subset of the entire population who knows about or owns any crypto. While we might consider a lot of what we see to be relatively known or common knowledge, there’s an entire community on YouTube who have never heard of CT. You know, the ones who own XRP and ADA.

Crypto as a whole is still one big echo chamber. We’ve been unable to convince the world that Bitcoin isn’t bad for the environment, or that minting an NFT doesn’t burn down 10,000 trees.

So it goes.

Whether or not you want to admit it, that’s just the truth. We’ve been psyoped into thinking we’re still early or that we’re all going to make it. It’s better to realize it now than to wait a few years with bags that are down 90%. The optimal solution is to realize you’re a small fish in a big pond, sell your XRP and start rotating like a degenerate.

Many of us started out following pied pipers and paid shills into shitcoins, maybe losing a lot of money in the process. If you’re reading this article, congrats. You’ve made it to the good side of CT. Not only is it 10,000x more entertaining than anything on YouTube, but it’s much better for your net worth. Seriously, if you’re new to all this, unsubscribe from those shitty crypto YouTubers. But let’s move on from all this.

I was recently alerted to something that immediately caught my attention. Cyber–ethnography is a research methodology involves becoming immersed in virtual culture and observing on interactive web sites and in virtual communities as issues are discussed. Yes, that’s a definition. No, I’m not going to do a cited sources page for a Substack article.

Why did this strange, 21st century version of ethnography catch my eye? Think about what CT is.

Our side of Twitter is dominated by the anon. We don’t know who a lot of our friends and acquaintances are, use a lingo that’s some weird sort of hybrid between 4Chan and Xbox Live game chats, and share memes that would make little sense to anyone outside of our community. CT would be a case study for the ages in the field of cyber-ethnography.

I believe there’s no greater example of this phenomenon than The Frog Nation. Curious to what the Frog Nation might be, or how this all makes any sense? The truth is that I am curious, too. I’ll try my best to present my thoughts in a coherent way, but if this introduction has been any hint, that’s not going to be easy. Strap in, because it’s only going to get weirder.

I present to you the story of Daniele Sesta, and how one man has managed to change DeFi forever and grow an army of followers like nothing I’ve seen before. Oh, and I’ll also be diving into a new token being launched by Dani and his friend Andre Cronje. Let’s begin.

Time to analyze

With the incredibly anticipated launch of SOLID - Dani and Andre’s newest project -there’s a strong possibility that the ecosystem of Dani tokens goes up a lot more in the short term. However, before we go into the most sought after rebase ponzi coin the market has ever seen, let’s backtrack and try to understand the current Dani/Andre ecosystem.

Actually, before we dive into all that, it’s probably a good idea to give a background on both Dani and Andre for anyone who’s uninformed.

Dani has been involved in crypto for a while, and has recently grown in popularity due to his positive persona and involvement in a multitude of DeFi protocols. Dani’s followers call themselves the ‘Frog Nation’ and are some of the most loyal token holders I’ve ever seen.

Andre is primarily known for his creation of Yearn Finance, one of the most well known yield aggregators in all of DeFi. He’s also been at work on the Keep3r Network, which seems to still be in development.

Let’s dive in.

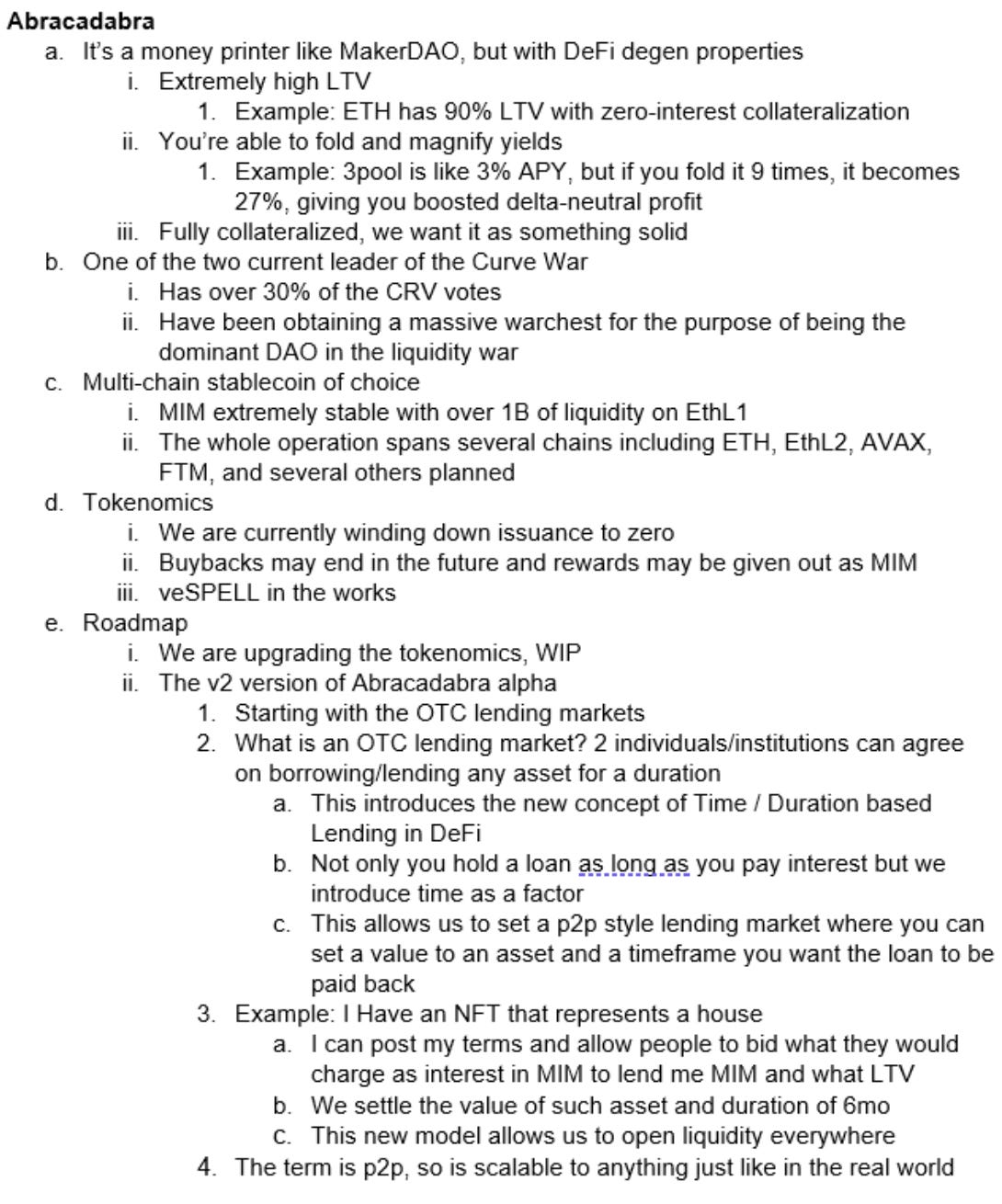

Abracadabra

Abracadabra has been one of the more successful DeFi projects of 2021, accumulating over $6 billion in TVL and launching the SPELL governance token. SPELL had a great year, rising from well below a cent to almost 5 cents, providing holders quite the return (around 3,400% from lows).

Abracadabra operates as a one stop shop for DeFi users, offering lending, farming and staking. While primarily starting out on Ethereum, Abracadabra has recently expanded cross-chain, allowing for a gain in popularity in both the Avalanche and Terra ecosystems.

Dani has been involved with Abracadabra from the start, and this is one of his more actively tweeted about projects. Whether it be an announcement about an upcoming token burn or a replenishment of Abracadabra’s native stablecoin MIM (magic internet money), it seems that Dani is more involved with Abracadabra than he is with something like Popsicle.

Abracadabra has grown its reputation partly due to the sign-on from Tetranode, with this internet whale recently sharing some alpha in the form of notes. Check it out for yourself.

See that line about the Curve Wars? Dani doesn’t mess around, which is why Abracadabra has been so hard to forget about lately. Even in an environment like CT where narratives come and go every week, Dani and the Frog Nation haven’t let Abracadabra fall out of the loop. It’s been very impressive to see.

With plans for veSPELL and reduced emissions, it’s hard not to be bullish on Abracadabra long term. We’ve already seen cross-chain compatibility on Abracadabra with the Degenbox strategy. Adding some incentives for users to bridge over to Fantom couldn’t hurt, and could lead the way for some very lucrative opportunities in the Fantom DeFi ecosystem.

Wonderland

Moving on to one of the more explosive projects of DeFi from 2021, I present Wonderland and TIME, its rebasing token. The first OHM fork on Avalanche, Wonderland was able to accumulate quite the treasury, at one point flipping the market cap of OHM itself.

TIME can thank Tiktok for some of its success, after many young investors caught on to the project and its ridiculously high APY. Despite some road bumps and TIME currently being far removed from its highs, Wonderland has still managed to hold onto its PoL and remain in conversation. Let’s call this ‘The Dani Effect.’

Even though a vast majority of OHM forks provided little to no value and faded away almost immediately, Wonderland was actually able to onboard new users to crypto, thanks to Avalanche’s low fees and Dani’s marketing of the project.

Who woulda thunk it.

Even though Wonderland has had some struggles recently, nobody can argue with a checkbook, and Wonderland may end up serving as Dani’s personal checkbook at some point. Can I back up these claims? Not really.

I just believe that given the option and if nothing else presents itself, Dani can take a chunk of the treasury and invest where he chooses. If this happens to be treating the Wonderland treasury as a venture fund that operates as a DAO, so be it. This would certainly be an interesting way of investing in the future of finance, and it would be in Dani’s best interest to own a stake in protocols that could prove themselves to be successful down the line.

This is all just speculation.

Olympus and Wonderland have experienced a bit of a price hit, and many are beginning to doubt if this new model of a protocol is fit to operate and accrue value back to stakers. Hell, maybe we just have to raise the APY again to make people feel better. I think there have been far too many overreactions and people are forgetting just how much is possible with a 9 figure bankroll. Regardless, prepare for more volatility.

Popsicle

For a while, Popsicle Finance flew under everyone’s radar while Abracadabra stole the spotlight. Essentially, Popsicle is a yield aggregator with plans of becoming the market maker of DeFi. Dani has stated that by Q4 2022, he hopes for Popsicle to bring a fully decentralised orderbook-based options trading platform - quite a lofty goal for a platform that would be competing against first movers like Dopex.

Popsicle has a little over $50 million in TVL and wishes to increase capital efficiency and provide users the highest yield they can. Operating as a chain agnostic yield aggregator, Popsicle has many opportunities for those who wish to earn higher APYs while exploring the possibilities beyond the Ethereum blockchain.

Popsicle aligns with Dani’s overarching theme of achieving an efficient financial infrastructure, with the help of Popsicle to link the previously unlinked siloes of the cross-chain ecosystem. If you haven’t noticed yet, Dani has a goal of achieving an open DeFi, one where users can interact with whatever chain they want without even knowing what chain they’re using. One of Popsicle’s major products that accomplishes this is Sorbetto, which takes users’ deposits and sends them cross-chain to earn yield.

While Popsicle hasn’t had much of a spot in the limelight lately, Dani’s recent tweets have shown he still has interest in the project doing well. Time will tell (no pun intended) how this will pan out, but it’s bold and it gets the people going.

Sushi

One of the more unexpected announcements of late 2021 was Dani’s proposal to Sushiswap and the subsequent pump of SUSHI. After Sushiswap’s core team had a bit of a falling out (which I won’t go into here, too much drama and nonsense), Dani swept in to save the day with a perfectly timed proposal. His plans include to focus fully on Sushi’s ability to become the go-to multichain DEX and to revise tokenomics in order to provide value back to users.

Is this going to work out? Probably not.

I honestly haven’t been able to keep up with anything regarding Sushiswap, my timeline has been too much of a mess with the Curve Wars. However, I think that this is more of a pet project for Dani, and his recent escapades with Andre are probably going to be taking up a lot more of his time.

Maybe he does pull it off, it would be interesting to see Sushiswap gain some traction on Fantom. I think that could do a lot of good for a blockchain that needs its DeFi protocols to improve their UI drastically. But that’s just my opinion.

If SUSHI were to implement ve-tokenomics, however, shit would go ballistic. The world would turn inside out. Dani would flippen CZ’s net worth. This is just a pipe dream, but I think CT would lose their shit. This is why it’s important to own just a little bit of SUSHI incase Dani’s ever able to bring his dreams to fruition. Inshallah.

Yearn

Moving on to Andre’s history of projects, he’s best known for creating the behemoth known as Yearn Finance. While often trading like a stablecoin, Yearn is a beast - with over $5 billion in TVL and one of the most open and productive DAOs in all of crypto, Yearn doesn’t disappoint. Having started out with a fair launch approach (sounds familiar), Yearn distributed their native token YFI, one of the more well respected token launches that has been done in crypto.

Recently, Yearn announced a revision to tokenomics (veYFI) and token buybacks. Essentially, they want to become a black hole for YFI, as buying back their tokens with revenues earned can only benefit them in the long term - PoL, baby.

Yearn will always have a place in DeFi. Nothing has stopped them, and it’s hard to dispute their status as a top three protocol all-time, thanks to Andre and the dedicated team. I’m bullish anything Andre touches for this reason.

Keep3r Network

To be honest, there isn’t a ton of information out there on Keep3r. In their own words, Keep3r describes themselves as “decentralized network for projects that need external devops, and for external teams to find keeper jobs.”

There have also been rumors of veKP3R, in addition to a new DeFi primitive created by Andre that would allow for LPs to sell theta to earn additional yield on their positions. For more info on that, check out @JackNiewold on Twitter - he stays more on top of DeFi than I do, if you can believe it.

Whatever Keep3r turns out to be, it’ll probably have some kind of functionality with Curve Wars or even Andre’s new token. I have very little idea. The concept is pretty interesting, though, as it’s already planning on expanding to even more chains - including Fantom.

A very complicated puzzle

We have been given a 5,000 piece puzzle with only 842 pieces and have been tasked to solve it in two days. There is simply too much info on Twitter and too many roads that lead back to another to put this all into a cohesive thread or article. I’ve considered not doing this article more than a few times, and it’s taken me a while to come up with a structure that works. The trickiest part of this was determining the goal of Dani and Andre, but I think I have an idea of it now.

I’ll refer to Dani and Andre’s new token as SOLID, since that’s what it appears to be named based off of the teaser in Andre’s Medium posts. I know that it could also be called ve(3,3) but I’ll try my luck here and refer to its more likely name. After all, naming a token ve(3,3) is pretty lame and probably wouldn’t catch on with the masses.

In my view, SOLID is an attempt to expand upon the problem solving we’ve seen in DeFi. Going back to DeFi Summer of 2020, we saw liquidity mining quickly get played out. New protocol would pop up, huge incentives would be there for LPs, protocol would die out as LPs left once the rewards ended. Rinse and repeat.

OlympusDAO was able to fix this with their novel approach to protocol owned liquidity (PoL). Instead of having to worry about mercenary farmers, Olympus was able to incentivize staking and eventually bonding, to the tune of an over $700 million treasury. Bonds allowed Olympus to control their liquidity on a given time frame, because - if you weren’t aware - the bonds are set for a specified amount of time, meaning a depositor’s funds are essentially locked and given to Olympus.

Despite this innovation, the price of OHM has fallen swiftly from its highs. The same can be said for TIME and other OHM forks, but TIME is especially important given the Dani connection. Keep reading, it’ll make more sense after I explain more.

We’re now in a situation where both Olympus and Wonderland have huge treasuries, but almost nothing to do with them. I say they can’t do anything with the treasury, because thinking realistically, what can they do? Obviously their tokens can hold some form of intrinsic value. If OHM/TIME trades at a valuation below value of treasury assets, token is undervalued. But that’s boring.

None of us came to crypto to hunt for undervalued assets. We came here for 15 figure APRs and dog coins. Do I see a path for either Olympus or Wonderland fixing this? At the moment, I don’t. The rebase ponzinomics got a little bit ahead of itself and I think it’s a tricky situation for both protocols to be in. They’ve hit a dead end.

Continuing on, think back to the Curve Wars. Curve and Convex stole the show, displaying the power of vote escrow (ve) tokenomics combined with the influence of a whale like Tetranode. Many quickly caught on to this new meta, with coins like YFI and RBN announcing the adoption of Curve-like tokenomics. Despite CT moving to other trends like FOAN and SOLID, the Curve Wars are still very much a thing, and more protocols will most likely adopt ve tokenomics in the next couple months. Tokens locked away, supply go down, number go up. It’s been that easy.

Enter two titans of DeFi.

Dani and Andre both have many commitments and projects, with both having some connection of sorts to the Curve Wars. In this case, Dani has been slightly more involved due to his connections with Abracadabra. After witnessing the innovation and speculation that’s been rampant in DeFi, I can assume that these two got together and sought out a way to combine two of the biggest metas of DeFi.

Enter ve(3,3) tokenomics.

Yes, this is a real thing. And yes, it’s probably going to cause a lot of controversy or go up a lot. People like ponzis, so it’s almost a given. I’m honestly not sure how this will play out long term, but piggybacking off of two of the more recent metas is better than coming up with a new one - if the goal is short term price appreciation. Let’s go over how this works.

All of the info I’m going off of will be from Andre’s Medium posts. If the token releases or more info comes out as you’re reading this, sorry it’s outdated. Things move fast in the world of CT.

SOLID plans to combine the benefits of a deflationary supply via ve-tokenomics, a secondary market for locked tokens (which have previously been unable to be sold) and incentives for those who stake (rebase rewards). I know, that’s a lot. Let’s break it down some more.

Looking at SOLID fundamentally, it seems like the token was designed to provide a market for governance tokens. If you’re able to sell locked tokens on the secondary, this can be seen as selling votes. Because of the locking mechanics of ve-tokenomics, it makes more sense to lock for longer due to increased rewards. If an entire group chose to lock their tokens for the maximum amount of time, they could reap rewards and sell their tokens. We haven’t seen a dynamic like this before.

As I mentioned previously, I believe SOLID is an attempt to fix many of the issues in DeFi, one of the bigger ones being a lack of ability for buying a token as a proxy of a vote in the Curve Wars. This is similar to what [Redacted] has done, but with some small differences. [Redacted] purchases CVX, CRV and OHM through bonds, while SOLID hasn’t mentioned anything like that - yet. The Curve Wars have not migrated over to Fantom, but who knows what the future holds.

Moving on.

SOLID aims to be a fair launch token, as it’s going to be distributed via airdrop to the top 20 protocols by TVL on Fantom - a bold move, but one that might work. This has Andre’s name all over it, as Yearn Finance did the same with their native YFI. The strategy of airdropping to community also ties in with Dani’s anti-VC ideals and helps provide incentive to bridge to Fantom. It’s a win-win-win.

SOLID has some interesting tokenomics, as the more that supply is locked, the less emissions there will be, in addition to a higher APR for locking, hence the (3,3) aspect.

By giving liquidity to protocols, this can function as an AMM that isn’t controlled by liquidity mining, rather communities. This is a more interesting take on PoL, essentially turning the idea on its head. It’ll be interesting to see how this plays out and how these protocols take advantage of the position they’re in.

Overall, this is a very novel approach. I think this could easily break its way into the upper echelons of DeFi status and potentially shift the meta, assuming all goes well. I’m not really sure when this all releases, but I’m sure my timeline will remind me the moment it does. Inshallah.

My thoughts on this situation

From an outsider’s perspective, it feels like Dani is doing too much at once. Whether or not he’s able to see his vision come to fruition, it makes very little sense to be spreading out his talent like he is. Sure, there are a lot of opportunities right now in the Fantom ecosystem and a rebasing veToken sounds pretty appealing. But it just makes no sense that someone can pull off a vision of this scale.

If Dani were to see the frog nation revamp Sushi, bring billions of TVL to Fantom and secure a cross-chain future via Abracadabra, I’d be shocked. This isn’t saying I don’t respect the hell out of Dani’s work ethic, because clearly he’s a grinder. It’s just a strategy that’s so different in comparison to anything we’ve seen. Dani is preparing to pull off the most successful horizontal acquisition of all time. He’s literally got his hands in everything.

Prior to writing this, I’d wondered if Popsicle Finance had fallen to the wayside in Dani’s life. I’d struggled to figure out a roadmap for Wonderland and how Dani would come up with more ways to provide value to TIME holders. I’d tried to envision a cross-chain world where Sushiswap was the go-to DEX for both frogs and suits alike. It’s beginning to come together in my mind, although I’m still skeptical.

If you haven’t read it, go check out this thread from @j0hnwang on Twitter. He does a really good job of describing some of DeFi’s overlords and puts some good words to paper. Dani is attempting to build the Lego Death Star of DeFi, grabbing up as many pieces as he can get his hands on. Will it play out well for him? I’m curious to see.

A lot of Dani’s coins have already outperformed most of the market by a wide margin, especially when you consider how many of the older DeFi tokens underperformed. Just look at the charts for SPELL and ICE, buying either of them from the lows would have made you a return that any TradFi fund manager would salivate over. Are they slightly overvalued right now? Maybe a little. But if we’ve seen anything on CT, even if something is overvalued it can always go up more. In fact, we’ve even seen coins with no value go up.

This has all been a very interesting rabbit hole to dive into. I’ve had to do a lot of reading, but even more thinking. Crypto moves so fast that it’s almost impossible to predict what will stick around next week, let alone in the next year. That’s why it has been so difficult to analyze Dani’s bold vision of a decentralized future led by a nation of frogs and a king tatted to the gills. Something of this scale has never been attempted before.

No matter what side you’re on, you have to respect the hustle of both Dani and Andre. Few in DeFi possess a work ethic like this, and even fewer would be able to tolerate the scrutiny and backlash they get. Whatever happens with SOLID, CT is in for a treat.

One can also commend Dani and Andre for doing the most they can to encourage a cross-chain future. Not all of us on CT can afford to transact on Ethereum everyday, let alone the average investor looking to experience DeFi. Hopefully Fantom can have some success here and achieve its goal of onboarding the masses to an affordable and fast blockchain.

Regardless of whether or not this project works out, Dani has created such an insane moat with the Frog Nation and his Twitter following. I find it hard to believe he won’t continue to succeed at a high rate. Dani has reinvented the image of the rockstar, transcending the boundaries of what it means to be popular on CT. He has amassed an army and has now recruited one of the most well respected builders to assist him in creating the ultimate ponzi token. God help anyway who tries to fade this.

May we all make it.

* Thanks so much for reading, it would mean a lot if you shared this on Twitter and follow me @knowerofmarkets. Share this with a friend and have them share it with a friend, ad infinitum. *

Thank you for that! ✊🏿🐸🌎

Going to read it three or four times to increase my baseline knowledge and future path for Dani's undertakings. Thank you so much!