Introduction

I’d like to begin by thanking @ABTestingalpha and @Galois_Capital for inspiring me to write this article. I was impressed by both Galois Capital’s report on the market (link here) and AB’s framework for monitoring narratives and staying up-to-date (link to tweet here). After examining both of these, I was able to come up with an idea for something I’d been tossing around for a while. I’ve commented pretty extensively on narratives in the past - I hadn’t had a proper explanation for everything until now.

Hopefully this will become the most extensive piece of writing on the topic of CT and crypto narratives available, as I’m looking to try something new and get ahead of the trend. You can find extensive quantitative analysis on almost any protocol or token out there, but my Substack is the only destination where you can find the complex intricacies of CT explained ad nauseum.

If you want to stay updated on my daily activities, follow me on Twitter @knowerofmarkets. I’m currently super busy with New Order DAO, [REDACTED] Cartel and - unfortunately - college. I somehow manage to post far too frequently on Twitter, despite my better judgment and the little voice in my head that tells me to stop. Without further ado, I present to you the most intricate psychoanalysis of the hivemind that is CT.

The three circles of hell

Stumbling upon CT over six months ago is nothing but a hazy memory in my head. I’d originally began my Twitter account under the name @knowerofstocks, before realizing that I knew a very pitiful above average amount of information about the stock market. I’d tried desparately to gain the powerful skills that come with DCF models and technical analysis, realizing in the process that I was an idiot and I didn’t have any edge in equities. I could try my best to find cool companies working no novel ideas, but the only ones doing anything worthwhile that I found interesting were either a horribly overvalued SPAC or a penny stock with a tremendously down bad chart.

I managed to harness the powers of the Twitter algorithm and started to see tweets from people like Cobie, Loomdart and Matthew Graham on my TL - it was then that I bought Solana at around 18-20 dollars a coin. It was probably late May or early June at the time and I quickly became swamped with my summer job, mowing 30 yards a week on my own with a push mower. I’d drive in my Honda CRV (fitting car model, I know) around and do about 5-6 yards a day, sometimes doing larger landscaping projects to earn extra money. I was too busy to check up on markets, so I did some swing trading on stuff like AMD and NVDA and did okay for myself. I was probably up around 50% on the year at that point, putting around 75% of my lawn mowing cash into the market. I’d totally forgotten about Solana over the summer, only diving into crypto and my @knowerofstocks persona every now and then to kill some time.

I’d also managed to buy a few OHM at around 200 dollars a coin, biting the bullet and paying the hefty gas fees to approve the contract and stake my coins. This was annoying, as $100+ for a single transaction was often more than I’d make in a day. Spending all this money on what was essentially nothing felt like an enormous waste - I’d stick to the stock market.

I found myself using Twitter more often once my freshman year of college started. I felt really awkward in some social situations and would try to sit in the corner looking busy on my phone to avoid the stress of meeting new people. Little did I know, this would be the greatest move I’ll probably ever make in my life. For as bad as CT can be and how little actionable information it can provide, I was able to change the trajectory of my life. I started a Substack, met a bunch of cool people in crypto and started writing for money; it was all a dream come true.

When I finally made the jump into absolute CT degeneracy, started following more accounts and discovered (what I thought was) a treasure trove of info on the crypto markets, I’d felt like I was the first to discover fire. What was this strange subset of Twitter, with all of these gigarich billionaires shitposting 24/7? It was unlike anything I’d ever seen before.

If you remember my account back then, I’d love to know what it was like as I really don’t remember much of what I tweeted. Life has moved so fast this past six months, it’s tough to say what any given week has been like. A day in crypto is a week in any other world, partly due to the 24/7 markets and the absurd behaviors we view on CT. As time went on, I realized just how naieve I’d been in thinking I was a genius for finding the cult of CT. Crypto was already well over a $2 trillion asset class and almost every coin had run like crazy throughout 2020 and 2021 - I discovered I was late to the party. It wasn’t until a few weeks ago where I realized that even though I was late to the party, I was still very early to the afterparty and the inevitable after-afterparty. The party isn’t over, so regardless of what time you showed up to it, there’s still some time to have fun and prepare for the next event.

Enough about me

In a discombobulated sea of whales, dolphins, fish, giant squid and everything in-between, I’m just another Twitter account with a silly profile picture. Anyone can choose to write about crypto and display it in an interesting or appealing light, but nobody likes to discuss the intricacies of CT in the long-form. There are an infinite number of writers on CT who can examine the technical aspects far better than I can, and just as many who can write more engaging paragraphcs than I can. Maybe there are some good articles about CT - I’m sure there’s a strong possibility @egirl_capital has beat me to the punch - but I’d love to try my hand and condense everything I’ve seen in my short time here. Regardless of my noob status, I figured I’d share some lessons I’ve learned along the way and go into my main thesis that inspired this piece, whether you like it or not!

We’ve seen many narratives play out since the latter half of 2021 and the general chatter surrounding narratives increase to dizzying heights. Any market can have narratives driving it, just as any asset can have a strong set of catalysts that might pick up steam and drive it to higher prices and bigger green candles. However, this reflexivity is exasperated in crypto due to the smaller number of players involved, operating in stark contrast to TradFi markets. It’s no secret that TradFi big dogs are making their move into crypto via private investments (a16z + everything in-between) and market making escapades (Citadel & Ken Griffin), but a vast amount of the real money in equities is still sidelined (afaik). Crypto has managed to divide itself into five major subsets, all carrying their own narratives, technicalities and figureheads. To keep it short, here’s the list I’ve come up with:

DeFi

NFTs

GameFi

Metaverse

L1s

I could be missing some, but just about every token falls into one of these main categories. There are exceptions of course, like privacy coins, infrastructure coins and the web3 space - there are coins that follow along these lines, but ultimately don’t catch as much traction as the big five. Crypto has quite obviously evolved in its over decade long lifecycle, with this coming new darlings and some long-standing titans that still fight for supremacy. The concept of what constitutes “a long time” is up for debate in crypto terms, but for the sake of this article I’ll say it’s either A) the entirety of a cycle or B) 2+ years. If a coin or project has lasted that long, it’s safe to say that the underlying has been around for “a long time” regardless of your own opinions.

Even though there’s a myriad of crypto content available to you, with everything from YouTube influenzas to traditional journalism painting a horrifically inaccurate picture of crypto, it’s pretty much unanimous consensus that CT is the best place to stay updated on crypto. Nowhere else can you find the titans of an industry engaging in open, conversational dialogue with their community. Would individuals like Jeff Bezos or Warren Buffett ever operate in a similar manner to Danielle Sesta (to give an outspoken example of this) or Vitalik Buterin? I don’t think so.

It might feel that CT is special or extremely niche, but at this point it’s hard to say we’re truly underground. Accounts like Cobie, Loomdart and Dani all show that there are hundreds of thousands keeping watch on our little financial playground, whether we want to admit it or not. While smaller accounts - those with less than 100k followers - are absolutely niche and still maintain the anarchist undertones at the core of CT, we’ve entered a new paradigm. It’s become increasingly difficult to be the first to a narrative or coin due to the rate of capital in-flows that have come at light speed these past few years. Big Twitter accounts have bigger bankrolls, and even smaller accounts that might not catch your eye (initially) possess even bigger bankrolls. The game of charades becomes even more kafkaesque when you learn just how many accounts you interact with are alts, alts of an alt, or alts of an alt of an alt. In moments like these, you realize just how strange CT is and how disconnected the culture can be from more traditional groups. We have anonymous whales masquerading as cartoon characters, billionaires sharing “alpha” on a near daily basis and millions of fish fighting for a chance at financial freedom - all in the same arena of Twitter dot com.

Digging into CT and navigating it follows the Dunning-Kruger effect, or at least it has in my opinion. I initially thought I’d found “the next big thing” and quickly realized just how wrong I was, taking a couple months to step back from content and try to learn as much as I can. In the process, I’ve discovered some valuable insights that can assist anyone in their daily endeavors of both the markets and CT. While you might not hit a 1000x off this advice, I believe it can help you become a smarter participant as you wade the murky waters and trek through the dark forest.

X, Y and Z

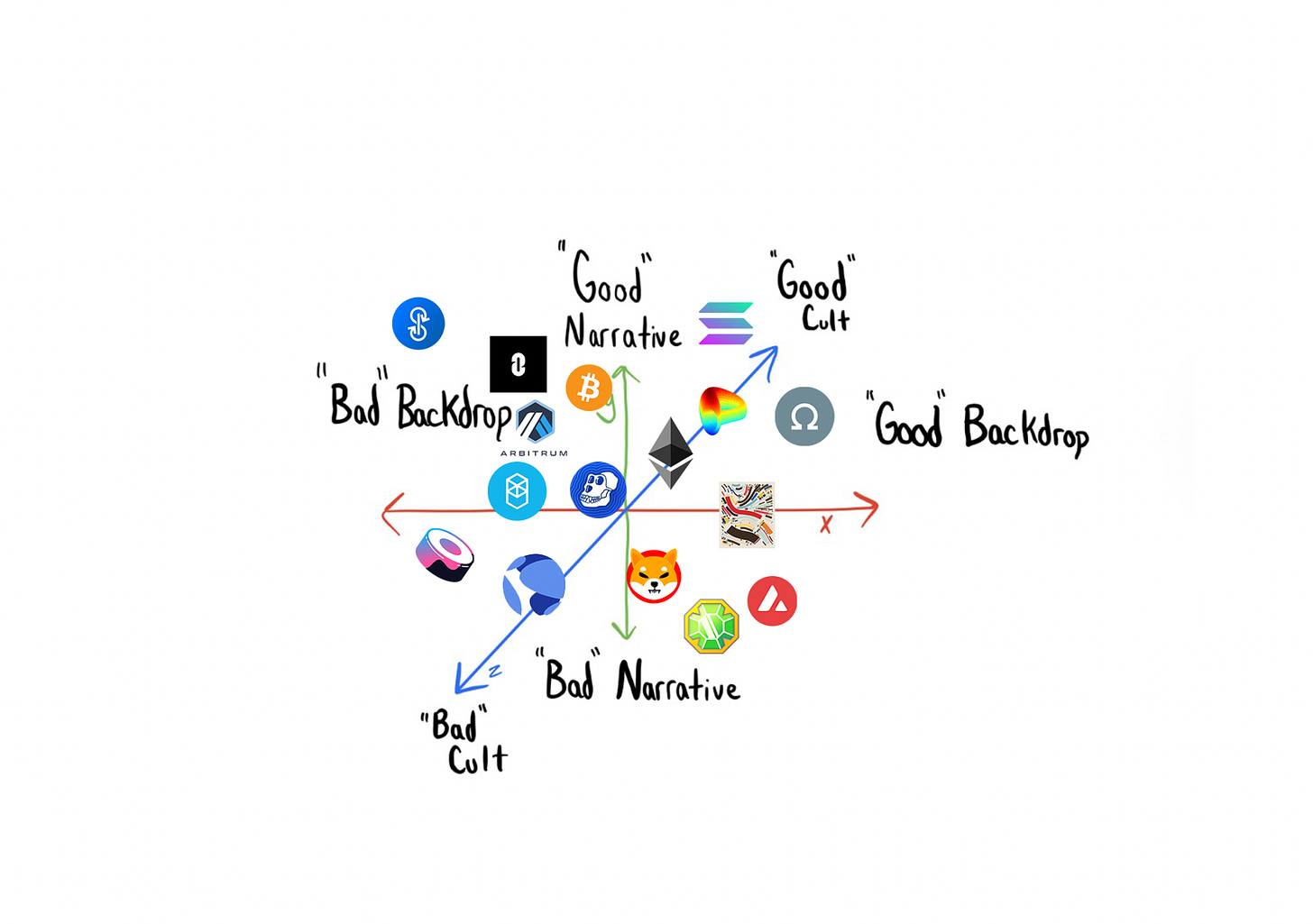

Galois Capital described the process of evaluating projects based off of two criteria: grift and utopianism. These two categorizations represent a spectrum, but are extremely helpful in identifying what makes something stick. In order to avoid regurgitating information and coming off as a shmuck, I’ve introduced some new criteria and a debateably helpful graph to assist you in your analysis. Applying this to the phenomenon of narratives, I’ve come up with this monstrosity:

It’s tough to look at, I know. This isn’t entirely comprehensive and is hardly an accurate portrayal of each criterion, but it’s a good visual to have in mind as you’re reading this article. By determining the qualities of a narrative based off of the underlying idea, market backdrop and the personality/traits of its cult, you can easily know if the current (or upcoming) trend is worth your attention and money.

To further compound the complexity of what I’m trying to say, I’ve applied the analogy of Dante’s Inferno to CT, with each level representing a different circle of hell. You’ll see some fun images I made in photoshop throughout this, so keep hell and suffering in mind as you read my ramblings. I’d consider the first level of hell to be filled with red candles and vast misunderstanding / naivety, with the following two circles representing an eventual acceptance of the chaos and a hope for success in the space. We all go a little crazy every now and then, some of us just experience this descent in a much more condensed form.

Sifting through the mental illness

Enough of my long-winded introduction, let’s get into the fun stuff that you can actually apply to your shitty trades and “long-term” investments. Here’s a picture of @ABTestingalpha’s framework I mentioned in the beginning paragraph of this article:

After stumbling on this, I felt like an idiot. It seems so simple in hindsight - ranking narratives and categorizing them based on the levels of attention they receive on CT. Cobie has talked about it on Substack before (link here), explaining how the most scarce resource in crypto is attention. This makes sense, as it’s almost impossible to revive a coin and its narrative. There are probably more dead coins still on the market than coins that are actively traded, this being a product of the attention war that’s been ongoing and relentless for long-term investors. It’s almost impossible to predict what coins will remain in conversation on a 3-6 month time horizon, let alone 3-5 years. Because of this unfortunate fact, we almost always fall fate to an underperforming and slow-dying position in our portfolio, by no fault of our own.

It’s important to determine where a narrative is at when you’re scouting your next opportunities. You can find yourself studying a narrative early, on-time or late. Contrary to TradFi markets, being early to a trend is not always your friend. Crypto moves at breakneck speeds, and if you get caught in something that hasn’t taken off yet, it could be weeks or even months before it even sees the spotlight, if it ever does at all. In crypto, this is an eternity. Being on-time to a narrative is absolutely ideal, but extremely difficult to time. Using the criteria I’ve mentioned above, I believe there is now a method that can benefit you as you attempt to find the next 50x microcap that you’re absolutely certain CT will go crazy for. Even if it doesn’t pan out for you the first couple times, there’s always that chance you pull a Satsdart and strike gold. Let’s look at a beloved example of a narrative we all know and love.

Trust the process

We’re all too familiar with the Curve Wars, some of us more than others. Regardless, we know what led into the glorious CRV/CVX pump and the DeFi 2.0 narrative which helped spark up my interest in DeFi and writing. To utilize the criteria I previously mentioned, let’s break down this narrative into its most basic parts. I’ll avoid giving another explainer on Curve and Convex, so if you want to brush up on this, go check out my previous articles here and here. Beginning with the market backdrop, crypto was coming off a brilliant run from its majors, along with a headwind of new protocols and ample attention on the space. NFTs had experienced a massive bull run spanning multiple months, and the market had almost entirely recovered from Q1/2’s issues and major hiccups. Macro talk was few and far between, anyone suggesting red candles immediately cast aside and left out of the conversation. Conditions were strong, and you know how much CT loves a good narrative…

CRV was an obvious choice, as the underlying token of Curve Finance had quite the brutal chart. Major figureheads like Tetranode led the charge, setting an example with aggressive bag shilling and plenty of hopium for the TL. Believe it or not, Tetranode was very much a popular influenza and his coins tended to do well in the short-mid term. The same can’t be said today, but Tetra coin meta was strong and filled with bullish energy.

Was the Curve Wars narrative a “good” one? This is a tricky question, but in my humble opinion it was. Defining a narrative as good or bad quickly becomes pedantic, so I’ll keep it simple.

A good narrative is one that looks to improve an underlying issue or serves to introduce a new paradigm into crypto, in one or more aspects. A bad narrative is one that comes off as a blatant attempt at stirring up exit liquidity, and can often lack coherent catalysts other than “TVL go up” or “x and y influenzas are rotating into x or y ecosystem.”

The Curve Wars represent a major shifting point on CT. Prior to this, narratives managed to fall under-the-radar as nobody was talking about this meta -and why would they? If you were one of the few who was a skilled rotator and nailing every narrative shift, why would you want to spill all the alpha? As more on CT began to decipher the narrative meta and determine the makings of each narrative, rotations became slightly more difficult. We saw this issue compound and lead to the unfortunate debacle surrounding EVMOS szn, which grew too big before it could even get off the ground. It had felt like basically everyone on CT was ready to ape, but this left a very large issue looming over everyone’s head: who would become the exit liquidity? For better or worse, this never really panned out. It’s still up for debate on what might have happened had CT been blessed with the elusive EVMOS szn. From here, the talk surrounding narratives really began to fall off, with many switching to macro analysis and more fundamental analysis into protocols and tokens. No narrative could overcome the vast chasm that now sat in the hivemind of CT, only singular, one-off pumps that could return the glory of prior trends.

Categorization

Ded, quiet, percolating and active are pretty much the only four terms that can be used to describe a narrative making its way through CT. Giving an example of each, you could base future calculations off the ways current (or ded) narratives have behaved and might continue to behave:

Ded = DeFi 2.0, Solidly and Evmos

Quiet = Eth Merge, Butterfly Wars and NFTs

Percolating = Solana alts, Music NFTs and Miladys

Active = Privacy coins, BAYC + Punks + Yuga Labs and DeFi 1.0 revival

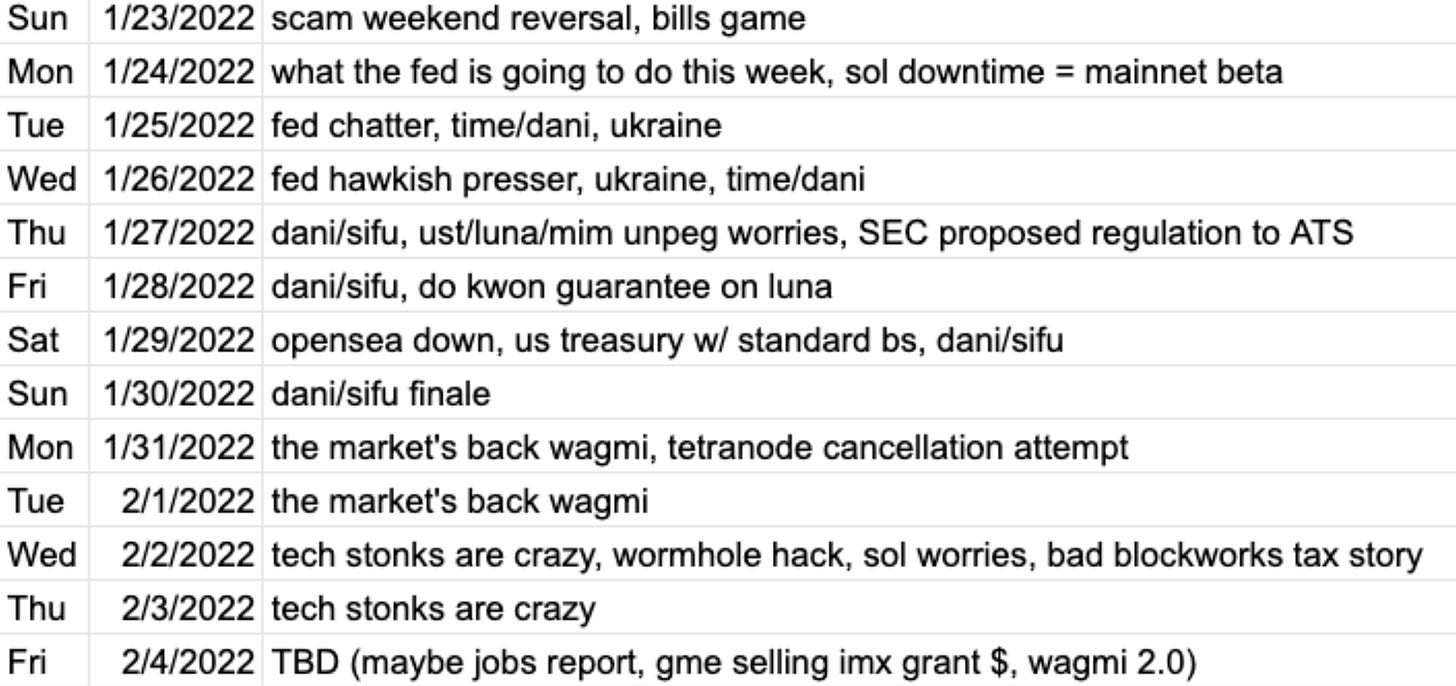

Yes, some of these fall into a spectrum that co-exists between the state of narratives. That’s too specific and it would be time consuming to calculate this with some sort of data scraping method, as the real works comes from doing further fundamental analysis on underlying tokens, protocols and ideas (trends). By combining various methods of analysis, APtestingalpha’s framework can serve as a boost to what you might typically do on a given day, assuming you’re an analyst of some kind. With the additional benefit of a narrative list in front of you, it becomes instantly apparent what needs to be looked at ASAP and what can get pushed aside. AB also utilizes a spreadsheet that tracks the biggest topics and conversations on CT each day, shown here:

This can also be extremely useful in tandem with the narrative framework, providing you a specific account of what constituted the talk of the town on any given day. Those who have more experience in data science than I do could probably come up with something that does this for them on a much higher level, but for most of us, this is enough to give even a slightly bigger edge. It’s important to stay ahead of the trend (but not too much) and maintain some form of alpha in this interesting little experiment. Don’t let GCR and Hsaka take all your money, rise up from the proletariat and become something bigger than yourself.

A meta within a meta within a meta

If you’ve made it this far, it should be apparent by now that CT is a cesspool for bad takes, predatory projects and far too many rugs. We all trip up every now and then and lose money, but spending time in a PvP environment of this caliber is undoubtedly useful in improving your grasp of financial markets and group psychology.

In a bull market you can pretty much buy whatever new coin you want and things will go up. In markets filled with uncertainty like we’re currently seeing, it’s essential to be diligent in what you buy, when you buy it and how much of it you buy. There are benefits to technical analysis and finding good entries, but TA won’t help you when everybody is talking about shibadogecrvape token while you’re talking to a brick wall about SOL re-testing its support. Lines don’t matter, words and movements do.

If I can give one piece of advice to anyone looking to enter crypto, it’s to go all-in with your attention. There isn’t another sector with a quarter of the buzz and excitement that crypto is currently experiencing. Sure, you might be a senior who is ready to graduate from your Ivy league and hit the investment banking world - but what harm would it be to take a few months off and experience a true financial revolution?

Follow the right accounts, follow some popular accounts and dig deep for the small accounts with low follower counts - those ones always bring the best alpha. Make friends, join a DAO, build up your stack and follow the big money (and loud voices!) if you want to experience probably the greatest casino the world will ever see. Crypto is a wild west and currently faces a huge chasm of information asymmetry that’s up for grabs to anyone willing to put in the time and take advantage of it.

Hopefully my walls of text didn’t scare you *too* much. If anything, I think these words can help you travel CT and avoid getting lulled into a dead-end or predatory narrative. It’s all too easy to think you’ve found a lottery ticket - don’t let the psyops get to your head and always remain diligent. Go out and do great things, anon.

Stay tuned for more articles that’ll be coming out soon. As a parting gift, go read this classic to gain an even better understanding of where you fit into the food chain - I promise it’s worth your time.

Thanks again to everyone who helped inspire me to write this. Whether you know it or not, your tweets keep me on my toes and I enjoy talking with most of you on Twitter dot com. If you enjoyed this in any way, here’s my Ethereum address if you’re in a generous mood: 0x7Db280BA0fd96619D55Cd18270435A41e25948a4.

Peace.

So super interesting. Being old school (and old) I appreciate the long form, where I don't have to mentally extrapolate meaning from images and cryptic, alternately spelled text. Thanks for this valuable insight.

I really like how you synthesize information and communicate. Since you are writing on narratives, I suggest you check out what's going on at Epsilon Theory, www.epsilontheory.com. Not shilling. Just a long time subscriber. Here's a most recent sample:

Our story so far …

The metaverse is real. It is an invisible, yet physically instantiated world of quadrillions of clustered human neurons alive in an electric ocean of neurochemicals, networked across billions of human brains through shared linguistic structures. These linguistic structures are the grammars of narrative. Like a microbe, these narrative grammars are profoundly alien to our conception of life, but a biological conception of narratives and a physical conception of their environment – the metaverse – is as important as a biological conception of viruses and bacteria.

Why? Because also like viruses and bacteria, these narrative grammars can be altered at a fundamental level through gain-of-function technologies. They can be weaponized. Big Tech, Big Media and Big Politics have made a conscious effort to weaponize these narrative organisms by inserting specific linguistic triggers that in turn shape the physical clustering of human neurons in ways that serve their interests. Big Tech/Media/Politics are changing the way we think.

Today we begin the battle to reclaim our humanity and our autonomy of mind.